Joshua

35 years . Freelance Web Developer .

Bachelor’s degree in Computer Science

InvestMate is a fintech app designed to simplify personal finance and empower users to make smarter investment decisions. In today’s mobile-first world, people increasingly rely on apps for managing their financial affairs. InvestMate offers a streamlined design, allowing users to effortlessly handle various transactions while providing an engaging and smooth experience.

Managing personal finances can be daunting and time-consuming, especially for those who are not financially savvy. Users often find it difficult to navigate complicated financial systems, manage multiple accounts, and keep track of payment methods efficiently.

The goal of this case study is to design InvestMate as a user-centered, easy-to-use app that empowers users to manage their finances effectively while making informed investment choices. The app prioritizes simplicity, accessibility, and ease of use, ensuring that users’ needs are met through thoughtful research into their pain points and behaviors. By addressing common financial challenges, InvestMate ensures a seamless and stress-free user experience.

35 years . Freelance Web Developer .

Bachelor’s degree in Computer Science

About Joshua is an independent graphic designer who values his creative freedom and the ability to choose his projects. While he enjoys the challenge of managing his finances, the unpredictability of his income makes it tough to maintain a clear financial strategy. Joshua is eager to find a simple and effective way to keep track of his finances and is interested in discovering new investment paths to build his wealth.

Goals

To develop a consistent approach to managing finances despite variable income streams.

To make informed investment decisions that support his long-term financial objectives.

To explore diverse investment avenues that could strengthen his financial portfolio.

To stay informed about financial developments and market trends that may impact his investments.

Frustrations

Worries about the privacy and safety of his financial information when using digital tools.

Struggles to find the time necessary for effective financial management amid his demanding workload.

Overwhelmed by the abundance of investment choices, leaving him unsure of where to begin.

Challenges in budgeting and future planning due to the inconsistency of his earnings.

Motivation

Attaining financial independence and stability for a secure future.

Gaining knowledge about emerging investment opportunities and effective strategies..

Valuing convenience and user-friendliness in financial tools.

Seeking access to premium financial services tailored to his specific needs.

30 years . Digital Marketing Specialist .

Bachelor’s degree in Communications

About

Emma is a dedicated digital marketing specialist who takes pride in her ability to balance work and personal life. She values efficiency and is always on the lookout for innovative tools to streamline her tasks and save time. However, Emma often feels overwhelmed by managing her finances, particularly when it comes to investment decisions. She seeks a straightforward, user-friendly way to handle her financial responsibilities without sacrificing too much of her time.

Goals

To gain control over her financial management

while feeling assured about her decisions.

To make knowledgeable investment choices that

resonate with her future aspirations.

To minimize the time and anxiety linked to

managing her finances.

To effortlessly access financial services via her

mobile device for greater convenience.

Frustrations

Feels daunted by the complexity of financial

systems and the variety of investment options available.

Has difficulty keeping track of multiple accounts

and payment methods.

Lacks in-depth financial knowledge and

confidence in making investment choices.

Struggles to find time for financial management

amid her busy schedule.

Motivation

To optimize her savings and engage in wise investment practices.

To enjoy a seamless and intuitive user experience in financial applications.

To improve her financial knowledge and develop a clearer understanding of her options.

To find high-quality financial solutions that cater specifically to her requirements.

By understanding the needs, motivations, and challenges of users like Joshua & Emma, we can design InvestMate to effectively address these pain points, offering a convenient and user-friendly solution for managing finances and making investment decisions, particularly for freelancers with irregular income.

“Managing my finances is tough because my income isn’t steady.”

“I want to make investment choices that support my long-term ambitions.”

“I wish I had a better grasp of the various investment options available.”

“Finding time for financial management is challenging with work and family responsibilities.”

“Flexibility and independence in my work are really important to me.”

“Effective financial management is essential for achieving my goals.”

“I should look into diversifying my portfolio and finding new investment avenues.”

“Keeping up with financial news and trends is vital for making sound decisions.”

Works as a freelance web developer.

Takes charge of his own financial management.

Actively searches for information on investment options and strategies.

Balances his professional duties with family commitments.

Regularly researches financial news and market trends.

Frustrated by the difficulties of budgeting with an inconsistent income.

Driven to attain financial stability and independence.

Eager to learn about new investment opportunities and strategies.

Overwhelmed by the lack of time available for managing his finances.

Anxious about the security of his financial data in online transactions.

“Managing my finances feels like a daunting and complex task.”

“I need a way to handle my finances that feels straightforward and reliable.”

“Staying organized and keeping track of my financial activities is a struggle.”

“I’d love to gain a better understanding of different investment opportunities and how to choose wisely.”

“I find it challenging to carve out time for managing my finances given my busy schedule.”

“I prefer financial management solutions that are user-friendly and efficient.”

“I believe handling finances shouldn’t be time-consuming or stressful.”

“I want to make investments that align with my personal aspirations.”

“Improving my knowledge of finance and investments is important for me.”

Works in digital Marketing Specialist

Actively seeks ways to manage finances responsibly.

Looks for time-saving and cost-effective financial tools.

Struggles with maintaining organization in her financial affairs.

Researches investment options but often feels lost and unsure.

Overwhelmed by the intricacies of financial management.

Eager to manage her finances more efficiently and with greater assurance.

Annoyed by the difficulties in keeping her financial activities organized.

Interested in investment opportunities but unsure of how to proceed.

Anxious about the limited time available for thorough financial management.

Starting with the low-fidelity wireframe, the initial step involved creating rough sketches to outline the basic structure. These preliminary designs aren’t intended to be visually polished but serve to lay the groundwork for the app’s flow and begin shaping it into a more defined framework.

Security is a top priority for any banking app. Users must enter a unique code with each login. For added convenience, FaceID or Touch ID is available, ensuring quick yet secure access.

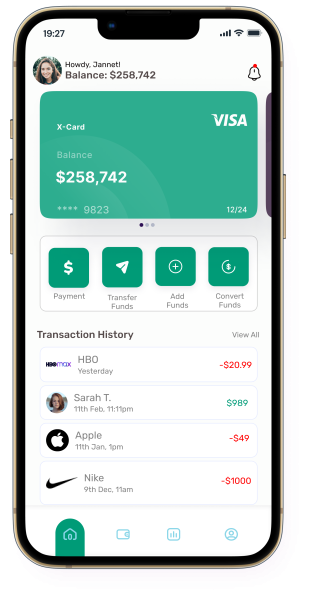

After authentication, the app welcomes users by name and showcases their profile picture, adding a personalized touch to enhance user engagement and satisfaction.

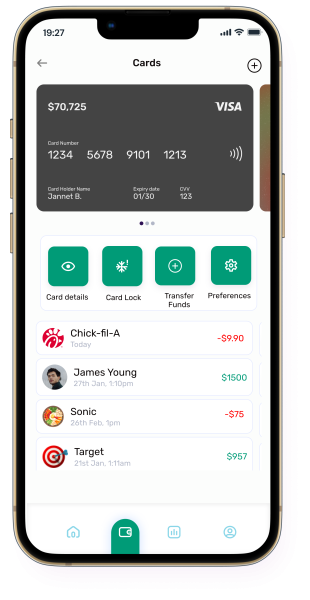

Access all frequently used features, cards, and products on a single screen.

Sections for cards and products can be expanded or collapsed for easy navigation. Users can open a new card or product directly from the status screen. If no products (like credits or deposits) are available, the app will suggest relevant options to apply for. Eye-catching, illustrative icons make the offers section stand out for better visibility.

Access all frequently used features, cards, and products on a single screen.

Sections for cards and products can be expanded or collapsed for easy navigation. Users can open a new card or product directly from the status screen. If no products (like credits or deposits) are available, the app will suggest relevant options to apply for. Eye-catching, illustrative icons make the offers section stand out for better visibility.

Green is used to represent income, indicating a positive balance.

For users with color blindness, a “-” symbol is placed before outgoing amounts to clearly distinguish expenses.

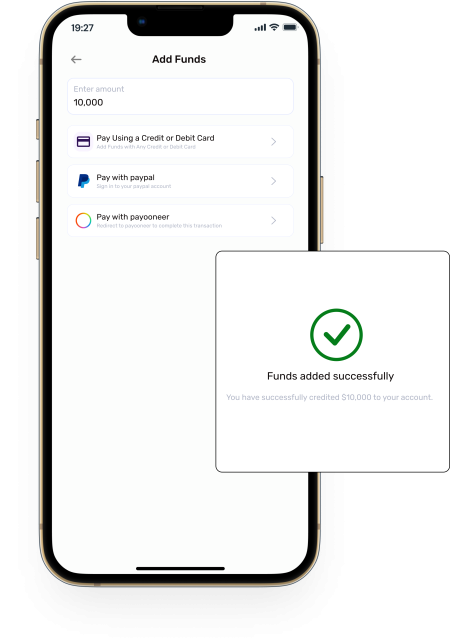

InvestMate simplifies the process of choosing between various payment options. Users can fill in their accounts with a debit/credit card, PayPal, or Payoneer, ensuring a smooth transaction experience with diverse top-up choices.

After each successful transaction, users receive tailored feedback directly related to their actions, providing clear confirmation of their completed tasks.

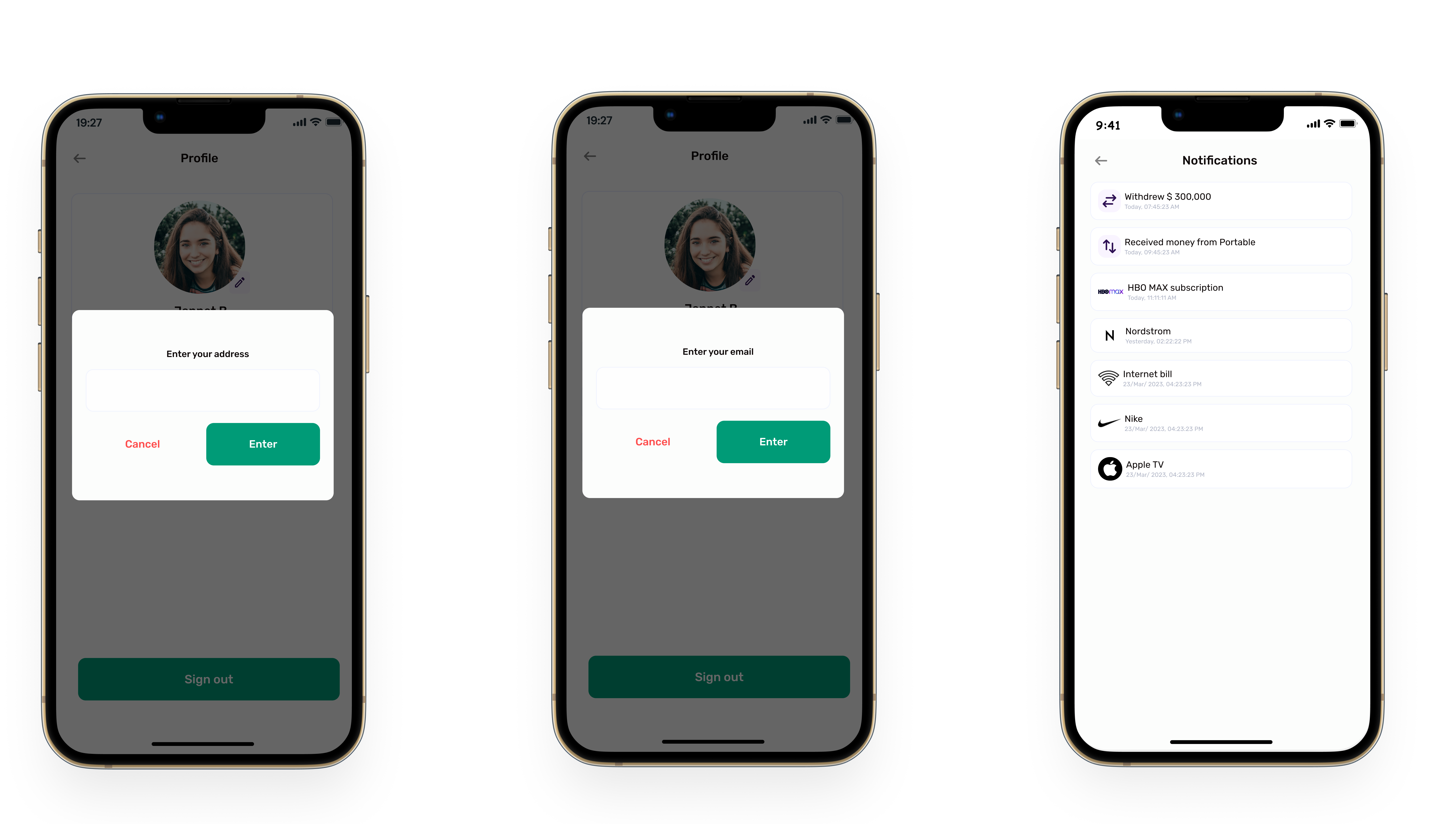

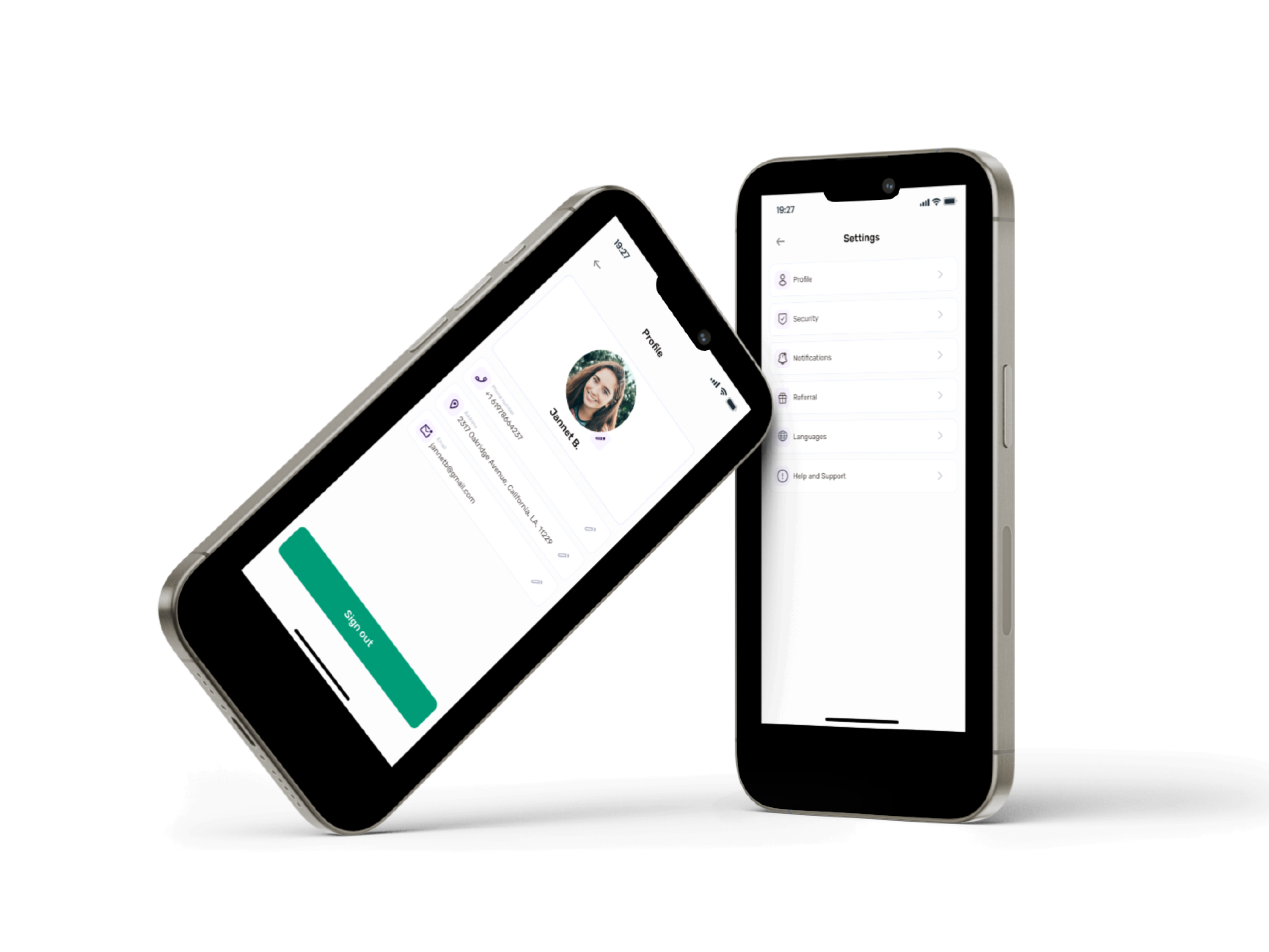

Users can update personal details such as name, address, email, and phone number in this section.

Additionally, users can easily contact InvestMate customer support via a live chat feature, designed to assist and resolve issues promptly.

The app features a minimalist, clean, and user-friendly design. Special attention was given to accessibility, ensuring it caters to users of all ages, providing an intuitive experience for everyone.